11 Which of the Following Best Describes Term Life Insurance

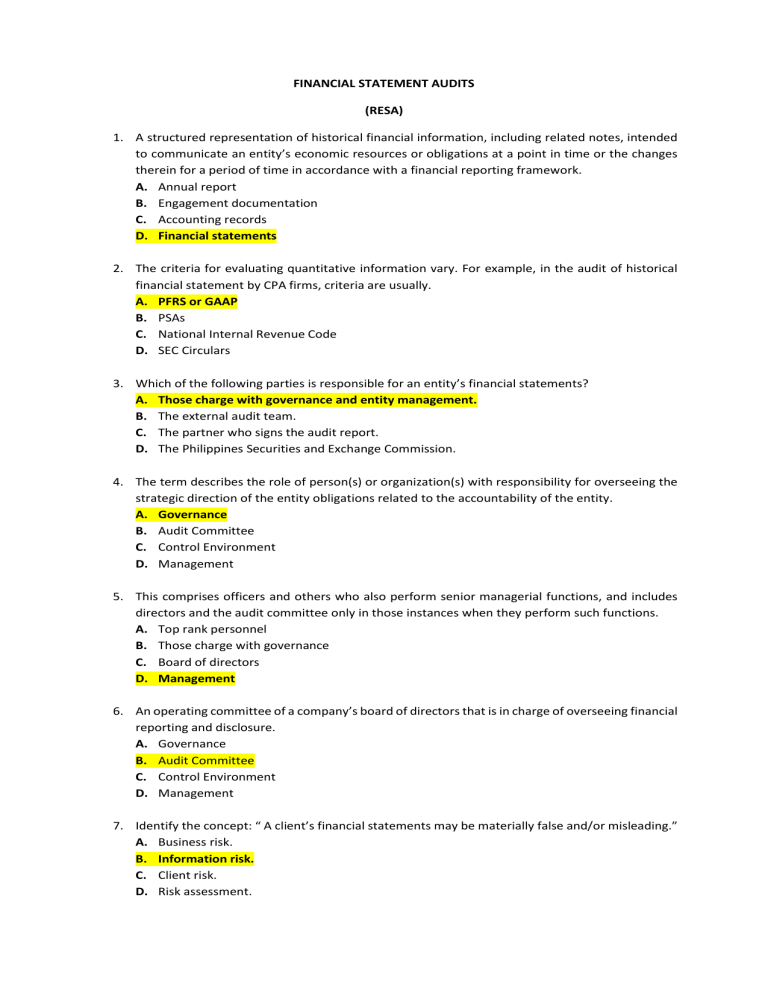

Term life insurance allows you to save money and place it into other accounts that will grow. The insured is covered during his or her entire lifetime.

Which Of The Following Best Describes Term Life Insurance Term Life Insurance Term Life Permanent Life Insurance

Which of the following best describes term life insurance.

. All of the following best describes Term Life Insurance EXCEPT. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. B It provides an annually increasing death benefit.

Renewable term insurance can best be described as. The type of policy that can be changed from one that does not accumulate cash value to the one that does is a. Added 20 hours 56 minutes ago4222022 32824 AM.

Which of the following best describes term life insurance. The insured can borrow or collect the cash value of the policy. Is a tool to reduce your risks.

The insured is covered during his or her entire lifetime. The insured pays a premium for a specified number of years. C It is level term insurance.

Try this site where you can compare quotes from different companies. When would a 20-pay whole life policy endow. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

Which of the following best describes term life insurance. Neither the premium nor the death benefit is affected by the insureds age. The insured can borrow or collect the cash value of the policy.

The insured pays a premium for a specified number of years. It requires proof of insurability on each renewal. Buena Terra Corporation is reviewing its capital budget for the upcoming year.

The choice that best describes term life insurance is. It is a level term insurance. The insured pays a premium for a specified number of years.

Units costs beginning work in process inventory 2500 beginning. This answer has been confirmed as correct and helpful. The insured can borrow or collect the cash value of the policy.

The insured pays the premium until his or her death. Log in for more information. The insured pays a premium for a specified number of years.

Log in for more information. The insured can borrow or collect the cash value of the policy. Which of the following best describes annually renewable term insurance.

A level death benefit with a raising premium. And these costs can be from 100 to several tens or. The companys target capital structure is 60 equity and 40 debt it has 1000000 shares of common.

All of the following best describes Term Life Insurance EXCEPT. Which of the following best describes term life insurance. Added 4142012 54814 PM.

Which type of life insurance policy is best suited for paying off the outstanding balance of a 30-year mortgage in the event of the insureds death. What statement best describes the term insurance. It has paid a 300 dividend per share DPS for the past several years and its shareholders expect the dividend to remain constant for the next several years.

The insured pays a premium for a specified number of years. The insured is covered during his or her entire lifetime. 4202022 115757 AM 11 Answers.

The policy owner is unable to continue the premium payments. Which of the following best describes term life insurance. The insured pays a premium for a specified number of years.

Which of the following best describes term life insurance. The insured is covered during his or her entire lifetime. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

When the insured reaches age 100. A Neither the premium nor the death benefit is affected by the insureds age. Which of the following best describes annually renewable term insurance.

It should be noted that coverage is also for a specified number of years. Which of the following best describes a life insurance agent. Written for a specified time period.

It provides annually increasing death benefit. The insured pays the premium until his or her death. The insured pays the premium until his or her death.

With answer 4 a whole-life or universal life policy both offer a cash-value savings account that is tax deferred. The insured pays the premium until his or her death. And these costs can be from 100 to several tens or.

Annual renewable term insurance ART is a type of term life insurance that lasts for a set period of time. Which of the following best describes term life insurance is a tool to reduce your risks. The insured is covered during his or her entire lifetime.

The insured pays a premium for a specified number of years. The following best describes term life insurance. The following best describes term life insurance.

The insured pays a premium for a specified number of years. The insured pays the premium until his or her death. A 50000 whole life policy with a cash value of 10000 has been in force for 11 years.

The insured pays a premium for a specified number of years. Limited pay whole life. The insured is covered during his or her entire lifetime.

Which of the following best describes term life insurance. This means that youll slowly accumulate money the longer you hold the account. The insured can borrow or collect the cash value of the policy.

However we still believe a term life insurance. Which statement best describes the term insuranceSOLUTION. The insured is covered during his or her entire lifetime.

Log in for more information. The insured pays a premium for a specified number of years. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

The correct plural of the noun attorney is _attorney. Which of the following best defines target premium in a universal life policy. The insured can borrow or collect the cash value of the policy.

The insured is covered during his or her entire lifetime. Which of the following best describes term life insurance. 30-year decreasing term Under an adjustable life insurance policy which of the following may NOT be changed without further underwriting.

The insured can borrow or collect the cash value of the policy. The insured pays the premium until his or her death. The insured pays the premium until his or her death.

High School Biology Midterm Biodiversity Evolution High School Biology Midterm Biology

Metacognition Thinking About Thinking Metacognition Metacognition Strategies Teaching Metacognition

Mlops Machine Learning Ops And Why It Matters In Business Fourweekmba Enterprise Application Machine Learning Learning Framework

So The Graphics Are Horrid But The Content Isnt Too Bad Although American How To Start Conversations Fun Facts How To Plan

Which Of The Following Best Describes Term Life Insurance Term Life Insurance Term Life Permanent Life Insurance

Enter All These Gifts Cards For The Best Chance Of Winning Life And Health Insurance Life Insurance Quotes Life Insurance Marketing

Vision Marinammedia Vision Statement Examples Vision Statement Vision And Mission Statement

No comments for "11 Which of the Following Best Describes Term Life Insurance"

Post a Comment